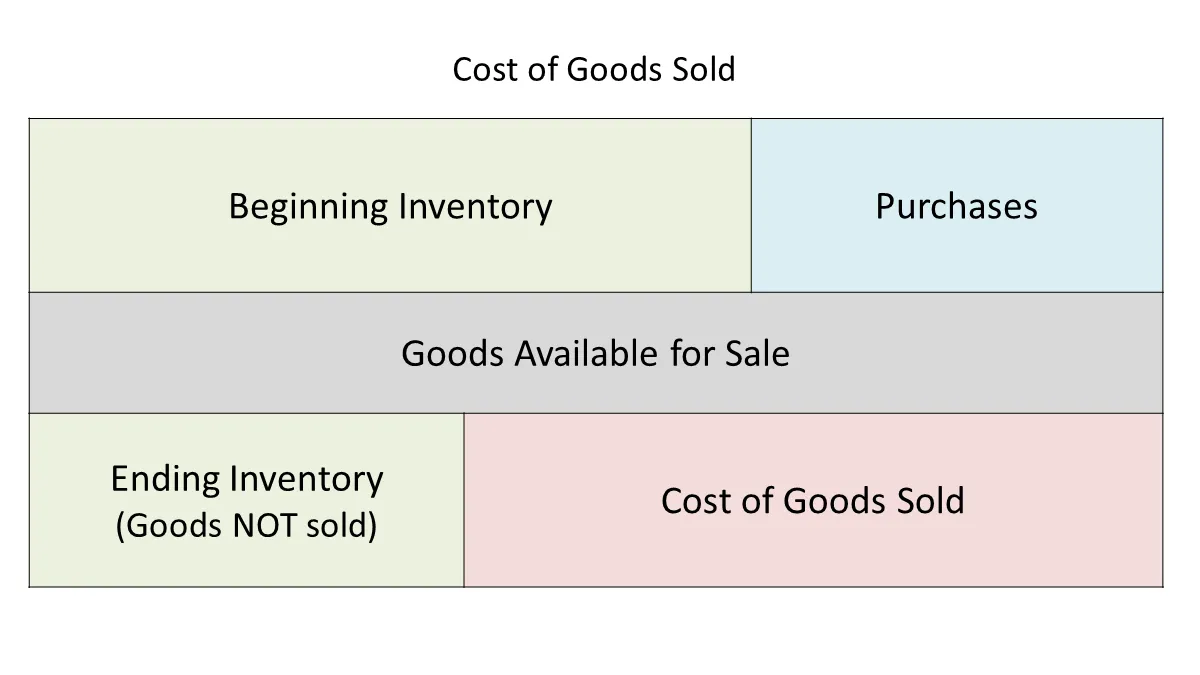

According to the Accounting Coach, the cost of goods sold (COGS) is the cost of the merchandise that was sold to customers compared to the cost of your goods still on hand. The cost of goods sold is reported on the income statement when the sales revenues of the goods sold are reported.

In AroFlo, this translates to the movement of values in and out of certain account codes during specific milestones in a task and invoice lifecycle. Most of our accounting integration options (with the exception of those listed in our Integration Comparison) support COGS.

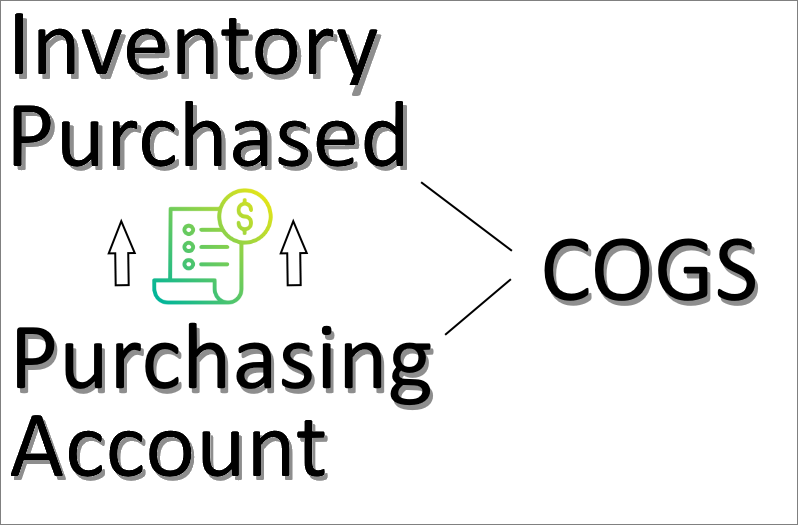

We can configure your company's integration link to enable you to track stock/item purchases through an asset account, and then track the sale of that item on an invoice through a cost of goods sold account.

COGS prerequisites

If you're not familiar with, or have never used COGS, please contact our Customer Service Team for assistance before proceeding. However, there are a couple of prerequisites you must meet before you can reliably use COGS in AroFlo:

| - It's important to have a basic understanding of the purchasing workflow in AroFlo and the difference between a purchasing account and an asset account. |  |

| - You must record Task material costs using inventory items. Use of ad hoc items added to a task will not generate a COGS transaction. | |

| - You must have COGS ticked in the post zones of your accounting integration. | |

| - You must have an Inventory Purchased account in your accounting integration mappings. This should be your asset account, or the value of goods held by your business. This is typically not a transaction account like the kind you would have mapped for recording purchases. |

It's important that you do not map or have mapped for you Inventory Purchased unless COGS is ticked in your post zones or you are actively using COGS. If this is mapped and you're not using COGS, your purchasing transaction records may be incorrectly directed into an irrelevant account.

How COGS Works

|

Your mapped asset account increases in value as you integrate bills from AroFlo and the value is rolled into your reported income on invoices as the cost of goods sold rather than ending inventory, which is goods not sold. The example below demonstrates the transactions that occur during the lifecycle of a COGS record leading up to when it is sent across to your accounting system. |

|

Example:

A single item purchase order and invoice. The purchase cost value of the inventory item was $100. It was sold to the end client for $130.

| Purchasing Account | Asset Account | Sales Account | |

|---|---|---|---|

| Purchase Order | $100 | ||

| Invoice | $130 | ||

| COGS transaction | +$100 | -$100 | |

| Results | $100 |

Add COGS to your integration link

If you would like to add COGS for your accounting integration link, please contact our Customer Service Team for assistance.

Final and Sales Invoices

AroFlo will create COGS transactions for any Final invoice. To track COGS for Sales Invoices, ensure the ‘Track inventory on Sales Invoices’ option in Site Administration is turned on.

COGS and SOR items

SOR or SOR Items can be added to any task or invoice and if not added from an SOR list, could affect your COGS transactions. When added correctly from an SOR List, then the item on the task will have a $0 Cost and will not affect the overall COGS amount. However, if they are not added from an SOR List, then they will transfer to the task with any cost value set on the SOR item in your inventory and therefore will affect your asset account.

COGS Troubleshooting

If you are integrating invoices and do not see any associated COGS entries, you can follow this quick three-step checklist. COGS are generated if:

- 'Supplier Invoice > Inventory Purchased' has an account mapping.

- The task has any inventory items recorded against it.

- A final invoice is generated.

Sending Bills outside of the month that goods were originally purchased in? As a bill being sent to your accounting package is the trigger for your asset account updating, it may look like the numbers for that month are out, but this is normal and would balance with what was missing for that month's reporting.

COGS are not generated for Part Invoices at this time and only for Final Invoices.