Households across Australia that install a small scale renewable energy system (solar, wind or hydro) or eligible hot water system may be able to receive a benefit under the Small-scale Renewable Energy Scheme (SRES) to help with the purchase cost.

Sometimes referred to as a rebate program, installing an eligible system allows the creation of Small-scale Technology Certificates (STCs), an electronic form of currency with a value that can be redeemed by selling or assigning them. Most households choose to assign their STCs to their installer for a discount on their system.

As a guide, one small-scale technology certificate is equal to one megawatt hour of eligible renewable electricity either generated or displaced by the system.

Source: Department of Industry, Innovation and Science.

Different states may have different rebate schemes

If this is the case, change ‘STC Deduction’ to the appropriate rebate scheme. i.e ‘Victorian Government Rebate’

| Requirements | How can I achieve this in AroFlo? |

|---|---|

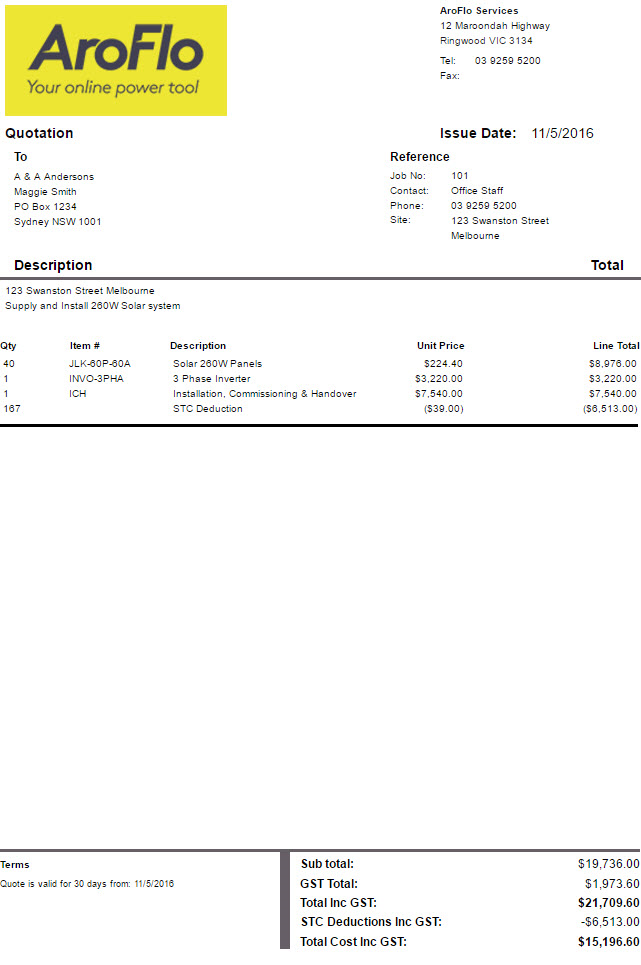

The following information must be clearly displayed on a quote/invoice:

|

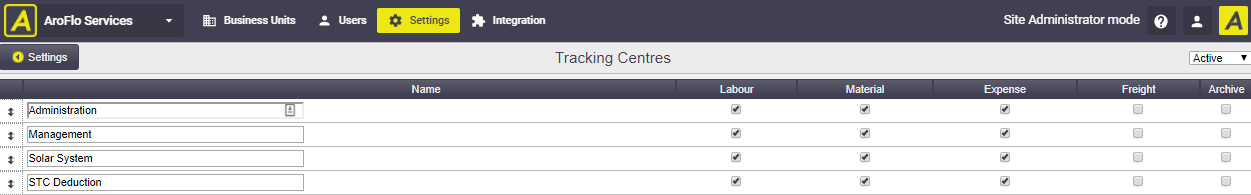

1. In Site Admin, set up Tracking Centres for 'Solar System' and 'STC Deduction' for the purpose of tracking Solar System costs and STC deductions. |

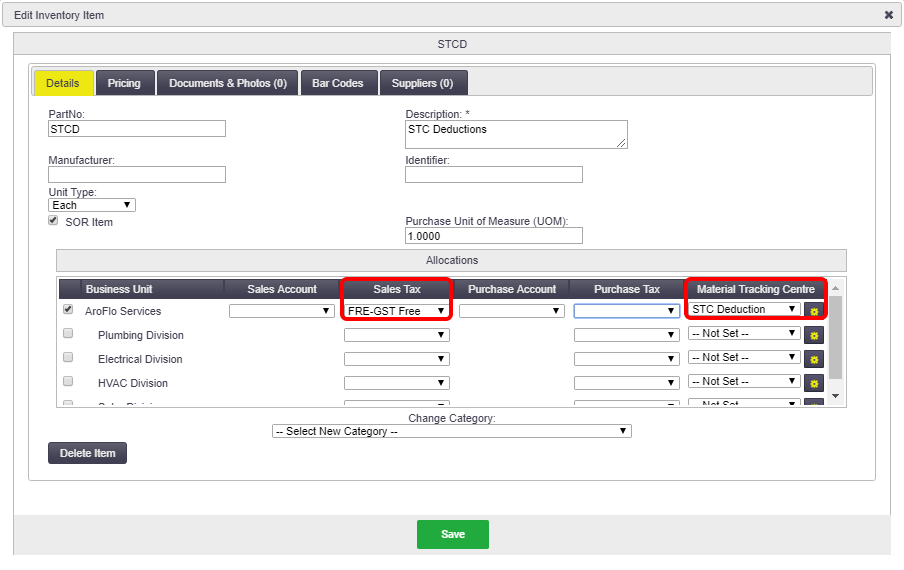

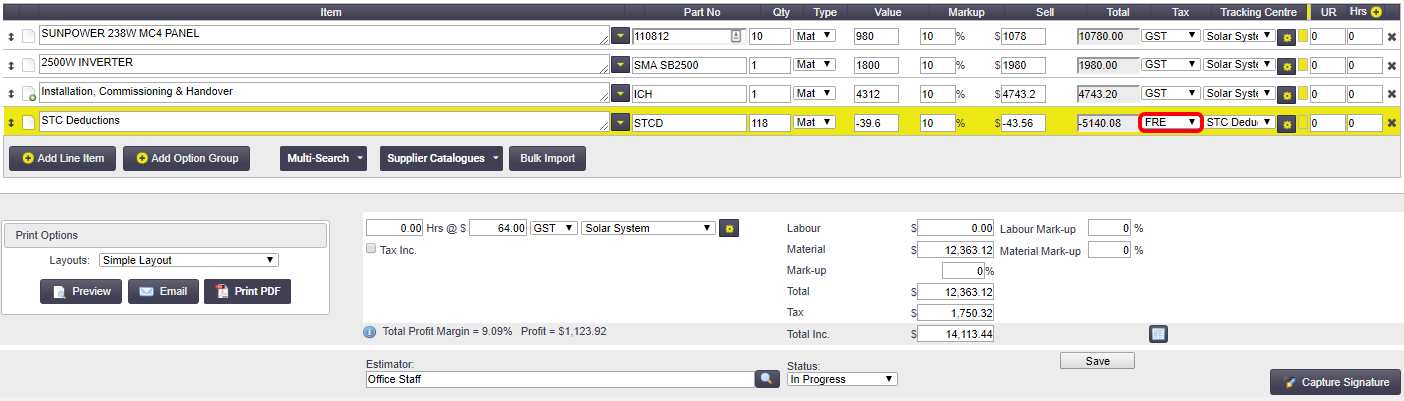

2. In Inventory, create an SOR item for 'STC Deduction' (linked to the tracking centre) for faster quoting and invoicing. Set this item to GST Free.  | |

3. After adding the inventory item for STC Deductions to the quote, ensure that the Tax is set appropriately. For domestic work, STCs are GST Free.  | |

|

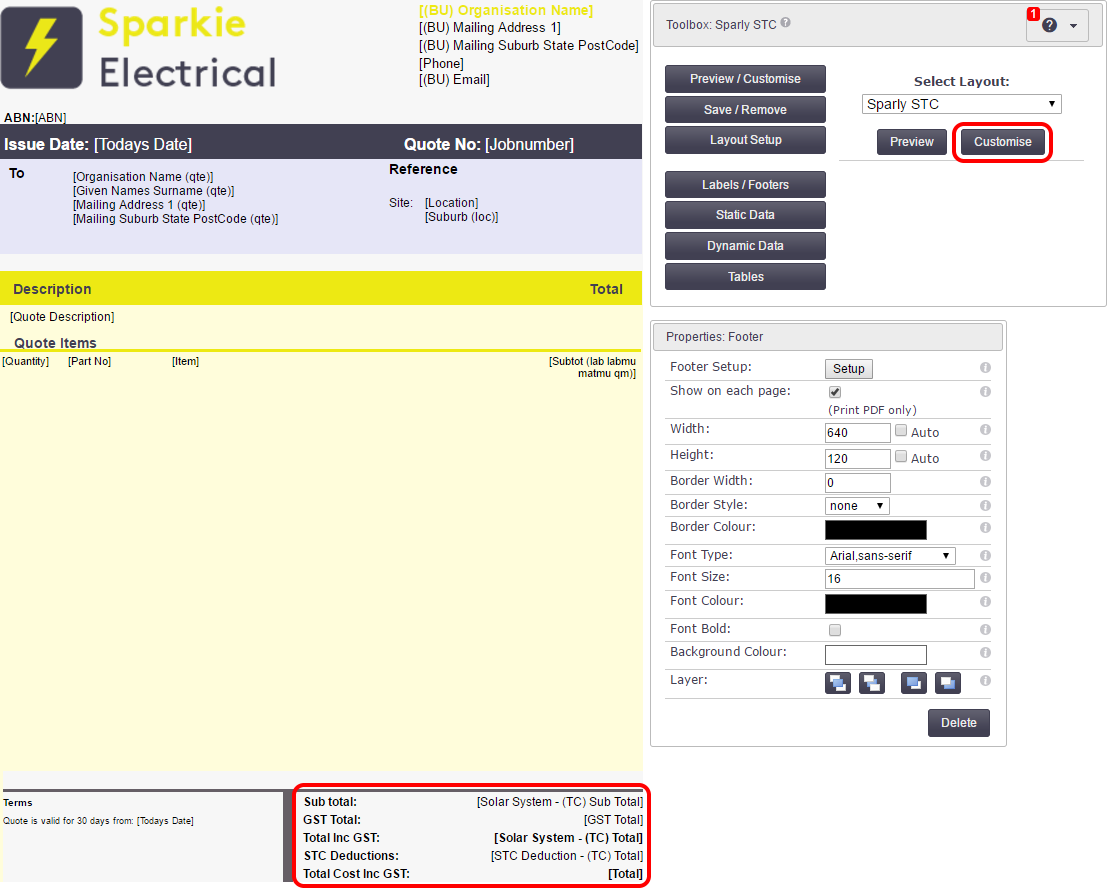

4. In your quote/invoice layout, customise the footer to include tracking centre data elements for 'Solar System' and 'STC Deduction' totals. Go to Sample Custom Layouts to quickly import a Quote and an Invoice layout showing STC Deductions.

|