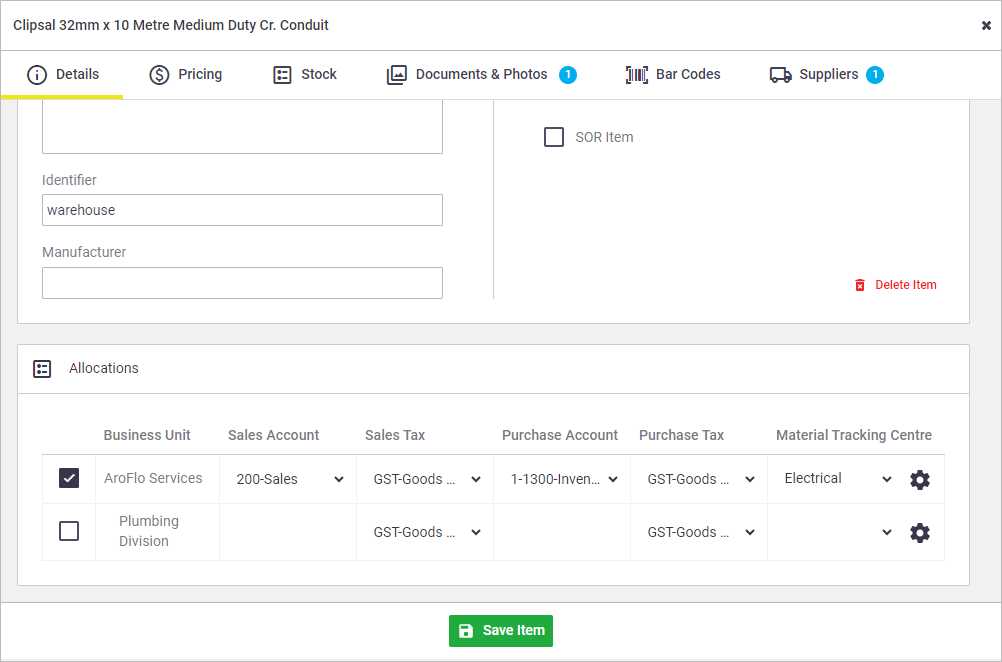

The Allocations section of the inventory item is used for setting unique account codes (for accounting integration purposes), tax codes and tracking centers, which are automatically allocated when the item is added to a quote, task, purchase order or invoice.

| Field | Description |

|---|---|

| Business Unit | If your site has multiple business units, you can make this inventory item available to other business units simply by ticking the appropriate business unit. |

| Sales Account (Code) | If your site integrates with an accounting package, you can assign a specific sales and purchase account code to inventory items. This ensures items are mapped correctly when posting to your accounts package. Account code hierarchy If no account code is set on the inventory item and:

Please contact our Customer Service team for assistance with mapping default account codes for Task Types or Business Units. |

| Purchase Account (Code) | |

|

Sales Tax Purchase Tax |

You can set unique tax codes next to each account code. This ensures the correct tax code is allocated to the item when it is added to a quote, invoice or purchase order. Tax code hierarchy If no inventory tax codes are set on the inventory item and:

|

| Material Tracking Centre | If your site has tracking centers configured in Site Admin, you can assign tracking centers to inventory items for reporting purposes. For instructions on how to set up and use tracking centers, see Tracking Centers. |